Our Plan for

-

HealthcareThe changes to Healthcare

HealthcareThe changes to Healthcare -

WelfareThe difference to Welfare

WelfareThe difference to Welfare -

TaxesSimplier filing of Taxes

TaxesSimplier filing of Taxes -

RetirementA better plan for Retirement

RetirementA better plan for Retirement -

Q & A HelpCheck our Q & A

Q & A HelpCheck our Q & A

How Taxes Works under Circulatory Spending

Taxes under Circulatory Spending will be much simplier. A one page tax form will be all that is needed to do your taxes. No more tax returns just a straight forward basic math is all that will be needed.

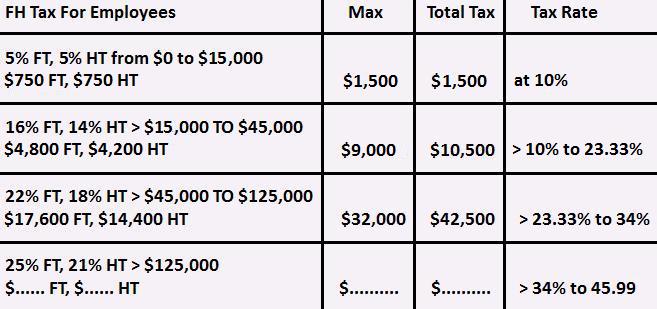

Taxes under Circulatory Spending will be much simplier. A one page tax form will be all that is needed to do your taxes. No more tax returns just a straight forward basic math is all that will be needed. With all the deductions and exemptions removed from the tax code your filing taxes will take you less than a minute to do. For employees here is another look at the tax code;

First, let's talk about why you are filing taxes since the taxes are coming out payroll style. There are a couple of reasons. You are filing to make sure that the correct amount was deducted from your check and not a penny more. You are also filing so that when an employer turns in what they paid in taxes to their employee that it both matches and it was the correct amount to put into your URHB account for the year. Plus if you have two or more jobs you will need to take certain steps to pay the correct amount of taxes. Also for your short term capital gains in such will be on a separate line.

Now how do you file taxes under the new Circulatory Spending plan? Let's pick a salary amount. Say you have one job and you earned $6,438 that year in salary, $2,800 more with tips, $200 in short term gains and $50 bank interest. Remember there is a separate tax on short term capital gains so that total is $9,238. You would simply place that amount on line one of your tax form. Then look at the first bracket total and see that you owe 5% FT and 5% HT on the first $15,000 of your salary. This means you would owe $461.90 in FT and $461.90 in HT. Since there was $200 of short term gains then you would owe 25% FT, 10% HT which comes up to $50 FT and $20 HT for a tax total of $70. You would then just sign it and date it and send in your W-2 along with your $70 and you would be done. You would be sending it in to the Universal Retirement Healthcare Bank tax department. This is the reduced version of the IRS. The new IRS will make sure that your employer put the right amount of money in your personal account. What if you make a lot more than that. Well lets take a look.

To determine if the correct amount was added to your personal URHB account by your employer all you need to do if follow this simple formula; Salary - 75% + $7,500 = Total for Year. But if you look at the first example the person made $9,238 that year. Since the first $10,000 of salary is at 100 percent then $9,238 is how much the employer should have put into your account that year. It should match what is on your W-2. If not then you need to get with your employer. That's it. No need for it to be complicated. Only if you made more than $10,000 in a calander year then what was added to your account should match the formula above.

If this person was working two or more jobs then it would work a little bit different. Let's say that this person had two jobs and the second job paid about $13,800 that year. Then first to determine the total tax this person would owe you would first add the $9,238 from the first job and the $13,800 from the second job to get a grand total of $23,038. Now subtract $15,000 to get $8,038. That total is taxed at the second level at 16% FT and 14% HT and this would be $1,286.08 FT and $1,125.32 HT and it totals $2,411.40. Now add $750 to both the FT and the HT to get $2,036.08 FT and $1,875.32. Now individually your employer would follow the tax code that means sense both jobs made less than $15,000 that means this job deducted a total of 10% to the Federal and Healthcare tax. On that portion they paid $1,151.90 FT and $1,151.90 HT. Just subtract the difference to get $884.18 FT and $723.42 HT for a total of $1,607.60 FHT you would owe. You can have what you owe deducted from your URHB account and it would not count as a withdraw from your account.

Now remember with two jobs each employer is adding money to your personal URHB account. So $13,800 - 75% + $7,500 = $10,950 plus the $9,238 from your second job means a grand total added to your account that year was $20,188. Add the fact that your total before tax salary that year was $23,038 that would give you a combined total compensation of $43,226. Now the taxes you owed came to a total of $3.911.40. Subtract that total from the $20,188 and that means $16,276.60 was the new gain from taxes. Now that is just a rough count based on that year but there would be more money in your account from past years and interest.

Even if you make let's say $800,000, no tips, short term capital gains of $4,800 that year the steps are pretty much the same. Just forget about the short term capital gains right now for your total salary to get $800,000. Since you made more than $125,000 you would then simply subtract that total from your salary of $800,000 to get $675,000. On this portion of money the tax is 25% FT and 21% HT. So $168,750 FT + $141,750 HT = $310,500 total. Add that to the totals on the scale for the first $125,000 and your total tax would be $191,950 FT + $161,050 HT = $353,000. The tax from your W2 would total $191,950 FT + $161,050 HT = $353,000 total tax. The totals should be exactly the same since it is coming out payroll style. Short term capital gains is taxed at a flat rate of 25% FT and 10% HT. Since there was short term capital gains the total is $4,800 then you would owe $1,200 FT and $480 HT for a tax total of $1,680. Then just sign and date it and send in your $1,680 to the URHB tax department. To verify that the right amount was added to your account then $800,000 - 75% + $7,500 = $207,500. That total should match on your W-2. This person's FHT was $353,000 - $207,500 = $145,500 or 18.19%.

Now if you remember that the reason there is no tax return because your employer is returning your money to you and placing it in to your own account that you can withdraw from when needed. This will save the government billions in tax fraud from tax return thieves. Every dollar saved will get us on step closer to paying off the rest of the national debt. Every dollar that the employer puts into your account will show up on your check stub in the box marked URHBT.

How Self employed Taxes Works under Circulatory Spending

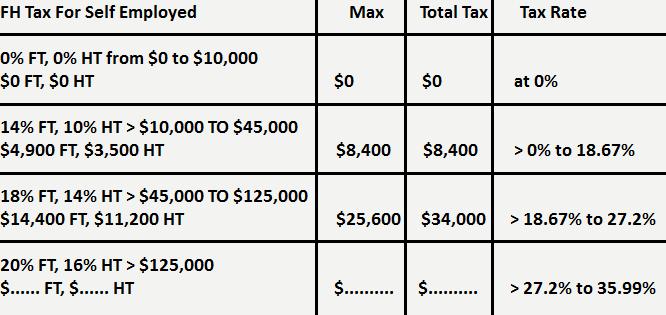

If you are self employed then take another look at this tax rate;

If you are self employed then your taxes will work a little differently. Your new Schedule C form 1040 deductible expenses will be removed except the 20% contribution you make to your own account and typical business expenses. Things like child tax credits, mortgage interest, charitable donations and healthcare premiums will be replaced with a round of 20% cut in taxes and the fact that your insurance premium for a different type of insurance is being deducted from your account and the interest your account pays is tax free and you make make withdraws from your account if you need money. Self employed will also have their state, city and county income taxes deducted as well as any property taxes paid for your home. Since Social Security is going to be in more of a bank format then they will be given deposit slips in which they can go to their branch when they choose and make a deposit to their account of what ever amount they choose plus pay towards the FHT for that year from time to time. Then at the end of the year you will be given a final total of what you deposited. Let's say over the course of the year you added $4,000 to your account and $1,800 FT and $900 HT and now it is time to do your taxes. For example, if your total income after expenses was $40,000 you will first calculate the percent to add to your personal account. So $40,000 - 80% = $8,000 to your personal account. Since you already added $4,000 that year then you would owe just $4,000 more. The $32,000 left over is then subject to the FHT. It you have a state income tax of 3.25%, city tax of 2.50% and county tax of 0.5% then you would have paid $2,500 in total state and local taxes. Subtract the $2,500 to get $29,500. If your property taxes was $1,500 then subtract that to get $28,000. Then since it is over $10,000 simply subtract $10,000 from $28,000 to get $18,000. That portion is taxed at 14% FT and 10% HT which is $2,520 FT + $1,800 HT = $4,320 total tax. This is a FHT rate of 10.8%. Since you already deposited money to those taxes then you would owe ($2,520 - $1,800 = $720 FT) + ($1,800 - $900 = $900 HT) = $1,620 total tax. Just sign and date it and send a total amount in of $4,000 + $1,620 = $5,620 to the new URHB tax division formally the IRS. Remember you will have a different type of health insurance that will deducted from your account if you choose to get healthcare credit plus if you ever get in a financial hardship you can make withdraws from your account just like everyone else. The capital gains is done the same way and at the same rate as an employee.

If your self employed and your total income after expenses was $850,000 and over the course of that year and you added $150,000 to your account and $100,000 FT and $70,000 HT then you would first calculate to put into your personal account. So $850,000 - 80% = $170,000 into your personal account. Subtract the $150,000 you already added to your account and you would owe $20,000 more into your account. Now Subtract the $170,000 from the $850,000 to get $680,000. Using the same state and local tax rates from the first example this person would have paid $53,125. Subtract that portion to get $626,875. This person paid $8,500 in property taxes so subtract that to get $618,375. The $618,375 left over is subject to the FHT. Since this is over $125,000 so 618,375 - $125,000 = $493,375 and the taxes on that portion are 20% FT, and 16% HT so $98,675 FT + $78,940 HT = $177,615 total tax. Add the totals for the first $125,000 from the scale to get $117,975 FT + $93,640 HT = $211,615. Since you already added money then you would owe ($117,975 FT - $100,000 deposited FT = $17,975 FT) + ($93,640 HT - $70,000 deposited HT = $23,640 HT) for a grand total of $14,015. Just sign it and date it and send the total of $17,975 + $23,640 = $41,615 to the new URHB tax division. Your FHT was 24.9% + 20% into your own account.

If you continue to work as self employed at age 65 then you would no longer need to put any more money into your account. You would only need to pay the self employed FHT only and you are done. At 65 a self employed person stills takes a 20% deduction from your taxable income plus subtract state and local income taxes and property taxes. Let say you have paid $1,500 FT + $800 HT over the course of the year to the FHT. So using the same $40,000 as your taxable income take $40,000 - 20% = $32,000. State and local income taxes was $2,500 so subtract that to get $29,500. Property taxes was $1,500 so subtract that to get $28,000. This is your new taxable income. Then since it is over $10,000 then $28,000 - $10,000 = $18,000. This portion is taxed at 14% FT and 10% HT and it comes up to $2,520 FT + $1,800 HT = $4,320 total tax. Subtract the $1,500 FT and $800 HT you deposited to the FHT and you would owe $1,020 FT + $1,000 HT for a total of $2,020. Just sign and date it and send in that total to the URHB tax division. The FHT would be 10.8%. For all self employed and non working people the capital gains tax is exactly the same.

How Employer URHA Taxes Works under Circulatory Spending

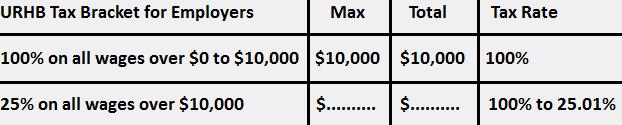

Now here is another look at the employer tax code for there employees;

The employer or corporation would send a copy of what they paid to their employees in their personal account as well as what they paid into their own account so the payments can be verified by the URHB tax department. When a corporation or employer pays taxes all they need to do is follow this formula below. Example of tax being paid by employer per week who's employee make $26,000 a year.

1. $500.00 - 0%[$0] = Employer pays $500 to employee account.

2. $500.00 - 0%[$0] = Employer pays $500 to employee account.

3. $500.00 - 0%[$0] = Employer pays $500 to employee account.

4. $500.00 - 0%[$0] = Employer pays $500 to employee account.

5. $500.00 - 0%[$0] = Employer pays $500 to employee account.

6. $500.00 - 0%[$0] = Employer pays $500 to employee account.

7. $500.00 - 0%[$0] = Employer pays $500 to employee account.

8. $500.00 - 0%[$0] = Employer pays $500 to employee account.

9. $500.00 - 0%[$0] = Employer pays $500 to employee account.

10. $500.00 - 0%[$0] = Employer pays $500 to employee account.

11. $500.00 - 0%[$0] = Employer pays $500 to employee account.

12. $500.00 - 0%[$0] = Employer pays $500 to employee account.

13. $500.00 - 0%[$0] = Employer pays $500 to employee account.

14. $500.00 - 0%[$0] = Employer pays $500 to employee account.

15. $500.00 - 0%[$0] = Employer pays $500 to employee account.

16. $500.00 - 0%[$0] = Employer pays $500 to employee account.

17. $500.00 - 0%[$0] = Employer pays $500 to employee account.

18. $500.00 - 0%[$0] = Employer pays $500 to employee account.

19. $500.00 - 0%[$0] = Employer pays $500 to employee account.

20. $500.00 - 0%[$0] = Employer pays $500 to employee account.

Stop! at $10,000 and next portion of salary at 25%

21. $500.00 - 75%[$375] = Employer pays $125 to employee account.

22. $500.00 - 75%[$375] = Employer pays $125 to employee account.

23. $500.00 - 75%[$375] = Employer pays $125 to employee account.

24. $500.00 - 75%[$375] = Employer pays $125 to employee account.

25. $500.00 - 75%[$375] = Employer pays $125 to employee account.

26. $500.00 - 75%[$375] = Employer pays $125 to employee account.

27. $500.00 - 75%[$375] = Employer pays $125 to employee account.

28. $500.00 - 75%[$375] = Employer pays $125 to employee account.

29. $500.00 - 75%[$375] = Employer pays $125 to employee account.

30. $500.00 - 75%[$375] = Employer pays $125 to employee account.

31. $500.00 - 75%[$375] = Employer pays $125 to employee account.

32. $500.00 - 75%[$375] = Employer pays $125 to employee account.

33. $500.00 - 75%[$375] = Employer pays $125 to employee account.

34. $500.00 - 75%[$375] = Employer pays $125 to employee account.

35. $500.00 - 75%[$375] = Employer pays $125 to employee account.

36. $500.00 - 75%[$375] = Employer pays $125 to employee account.

37. $500.00 - 75%[$375] = Employer pays $125 to employee account.

38. $500.00 - 75%[$375] = Employer pays $125 to employee account.

39. $500.00 - 75%[$375] = Employer pays $125 to employee account.

40. $500.00 - 75%[$375] = Employer pays $125 to employee account.

41. $500.00 - 75%[$375] = Employer pays $125 to employee account.

42. $500.00 - 75%[$375] = Employer pays $125 to employee account.

43. $500.00 - 75%[$375] = Employer pays $125 to employee account.

44. $500.00 - 75%[$375] = Employer pays $125 to employee account.

45. $500.00 - 75%[$375] = Employer pays $125 to employee account.

46. $500.00 - 75%[$375] = Employer pays $125 to employee account.

47. $500.00 - 75%[$375] = Employer pays $125 to employee account.

48. $500.00 - 75%[$375] = Employer pays $125 to employee account.

49. $500.00 - 75%[$375] = Employer pays $125 to employee account.

50. $500.00 - 75%[$375] = Employer pays $125 to employee account.

51. $500.00 - 75%[$375] = Employer pays $125 to employee account.

52. $500.00 - 75%[$375] = Employer pays $125 to employee account.

Stop! At $26,000 salary

Totals; Employer Paid $14,000 to employee account this year.

Example of tax being paid by employer per week "rounded to the nearest cents" who's employee make $65,000 a year;

1. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

2. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

3. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

4. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

5. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

6. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

7. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

8. $1,250.00 - 0%[$0] = Employer pays $1,250 to employee account.

Stop! at $10,000 and next portion of salary at 25%

9. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

10. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

11. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

12. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

13. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

14. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

15. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

16. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

17. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

18. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

19. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

20. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

21. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

22. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

23. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

24. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

25. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

26. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

27. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

28. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

29. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

30. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

31. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

32. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

33. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

34. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

35. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

36. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

37. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

38. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

39. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

40. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

41. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

42. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

43. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

44. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

45. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

46. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

47. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

48. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

49. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

50. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

51. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

52. $1,250.00 - 75%[$937.50] = Employer pays $312.50 to employee account.

Stop! At $65,000 salary

Totals; Employer Paid $23,750 to employee account this year.

Once you hit age 65 the money your employer pays will no longer go in to your personal account. You will be given two checks where it goes to you in take home pay. For the employer the system will look something like this;

Weekly salary;$1,250.00 - 75%[$937.50] = Employer pays $312 to employee as take home pay. Remember, 100% up to the first 10,000 of salary.

If you are already on social security and you choose to go back to work then the same deal applies to you as well. If you are getting social security disability then your payments will be reduced or eliminated all together based on current rules.

Since so many taxes has been reduced or eliminated for businesses with employees and no complicated federal corporate tax that means that the IRS will not be involved so much in most companies in America. The IRS will only be making sure that the FHT is being paid as well as self employed and employees are filing taxes as well as the capital gains and other taxes. They will also be making sure that the URHB tax is being sent out to employees by employers to the URHB if an employee is working at age 65 and older.

How Long Term Capital Gains Taxes Works under Circulatory Spending

Filing for long term capital gains and dividends taxes will be taxed separately as income since the new FHT is being taken out payroll style and there will not be any additional deductions or exemptions and a flat tax rate. Since it is not being taxed at the higher federal corporate level any more this will be a big tax break for all. The tax code again is;

* Long-term gains and qualified dividends after one year taxed at flat Tax of 15% FT and 10% HT.

* Short term capital gains less than one year a flat rate of 25% FT and 10% HT.

For example, If your capital gains was $5,000 in less than one year then you owe 25% FT and 10% HT to get your capital gains tax of $1,250 FT and $500 HT for a total tax of $1,750. The total tax rate would be, of course, 35%. If you have capital gains that total $2,000,000 after one year then it is taxed at 15% FT and 10% HT and that comes up to $300,000 FT and $200,000 HT for a total of $500,000 or, or course, 25% FHT.

How Collectible Taxes Work Under Circulatory Spending

The tax on collectibles will be a simple flat tax of 12% FT and 8% HT. So if a person has a rug worth $1,000 and sold it for $1,500 then $500 would be subject to the new taxes. That means $60 FT and $40 HT for a total tax of $100.

How Qualified Small Business Stock(QSBS) Taxes Work under Circulatory Spending

10% FT and 10% HT on QSBS with current exclusion. To qualify as QSBS under circulatory Spending:

* The stock must be in a domestic C corporation (not an S corporation or LLC, etc.), and it must be a C corporation during substantially all the time you hold the stock.

* The corporation may not have more than $50 million in assets as of the date the stock was issued and immediately after.

* Your stock must be acquired at its original issue (not from a secondary market).

* During substantially all the time you hold the stock, at least 80% of the value of the corporation's assets must be used in the active conduct of one or more qualified businesses.

Active conduct means a qualified business can't be an inactive business or investment vehicle. It can't be, for example:

* A service business in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, or brokerage services

* A banking, insurance, financing, leasing, investing, or similar business

* A farming business

* A business involving the production of products for which percentage depletion can be claimed

* A business of operating a hotel, motel, restaurant, or similar business

These are at flat rates with current exclusion because the tax is set at the lowest level to encourage new business start up in America.

How the FHT on after death URHB Monthly Payments Work

As long as you are alive the monthly payments given out to you are tax free. But once death has accurred then there will be a FHT on those remaining monthly payments. The tax rates are 16% FT + 14% HT. This means after death if you were receiving a monthly payment of $4,500 a month then from that point on the beneficiary would receive a new monthly payment of $4,500 - $720 FT - $630 HT = $3,150 per month. That would be the new monthly payment that who ever inherits the money going into the private account would recieve until that URHB account runs itself out of money. Keep in mind that states and local government may also include their own taxes.

With taxes being this simple most people will no longer need a tax professional just to file taxes. You could have your taxes done so fast you might even enjoy the experience, unless you owe but just think about how much money is in your new account to make you feel better.

NEXT